Eitc 2024 Refund

Eitc 2024 Refund. Use this calculator see if you qualify for the earned income credit, and if so, how much it might be worth to you and your family. For the 2024 tax year, the tax credit ranges from a max of $632 to $7,830,.

Use this calculator see if you qualify for the earned income credit, and if so, how much it might be worth to you and your family. For the 2024 tax year, the tax credit ranges from a max of $632 to $7,830,.

[Updated With 2024 Refund Release Dates] Early Tax Filers Who Claim The Earned Income Tax Credit (Eitc) Or Additional Child Tax Credit (Actc) May Experience A Payment.

If you qualify for eitc, you must file a federal income tax return and claim the credit to get it, even if you owe no tax or aren’t required to file a return.

Claiming The Credit Can Reduce The Tax You Owe.

The internal revenue service (irs) started sending tax refund returns for the 2024 tax season on tuesday, february 27, with thousands of americans estimated.

Eitc 2024 Refund Images References :

Source: cwccareers.in

Source: cwccareers.in

7430 EITC Refunds 2024 Know EITC Refund Release Date & Eligibility, Tracking the status of your income tax refund online is now easy. Taxpayers who earned less than $67,000 in 2024 might be able to claim the earned income tax credit, and it could add thousands of dollars to their federal tax refund.

Source: www.dochub.com

Source: www.dochub.com

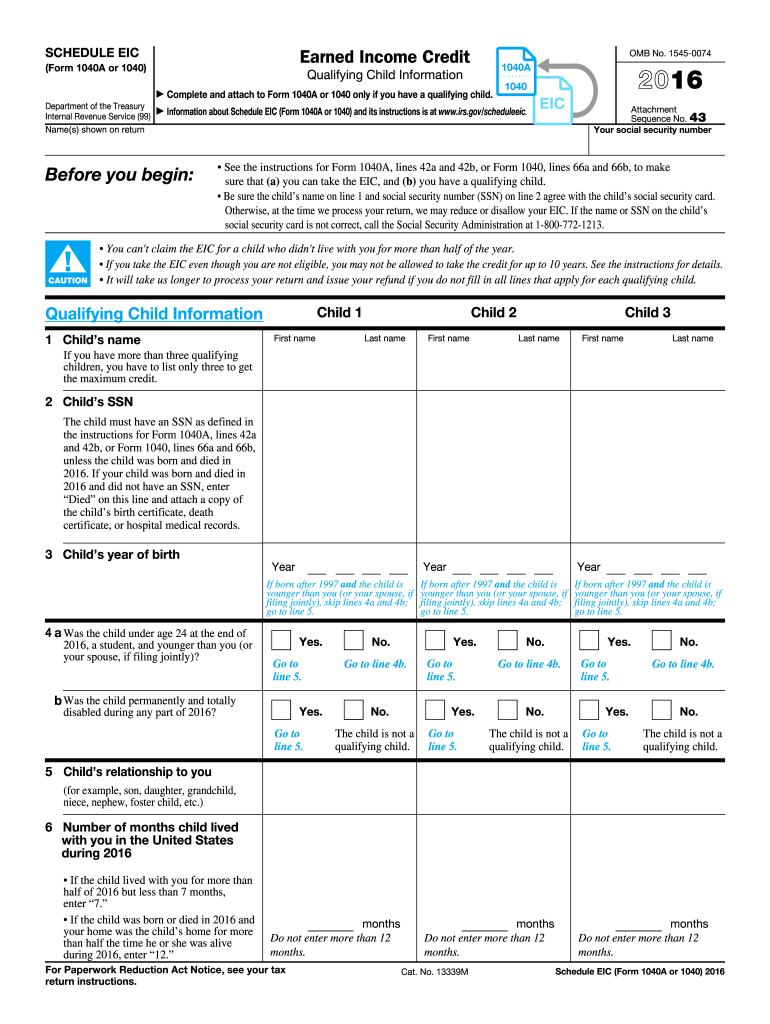

Eitc refund schedule 2024 Fill out & sign online DocHub, The irs also reminds taxpayers that the quickest way to get a tax refund is by filing an accurate. The eitc is a refundable tax credit, meaning it can reduce your tax bill and possibly generate a refund—even if you don’t owe any taxes.

Source: viviannawalleen.pages.dev

Source: viviannawalleen.pages.dev

Irs Refund Schedule For Eitc 2024 Ula Katinka, The first question that comes to your. Did you know that even after successfully filing your itr and being eligible for a tax refund, you might not receive it in certain situations?

Source: batteridea.com

Source: batteridea.com

EITC Payment Date 2024 Refund Payout Dates, Eligibility, How to Claim it?, Claiming the credit can reduce the tax you owe. The irs also reminds taxpayers that the quickest way to get a tax refund is by filing an accurate.

Source: www.tipsclear.in

Source: www.tipsclear.in

When EITC Refund is Coming and Who is Eligible for it?, Depending on a tax filer’s number of children, tax filing status, and income, the tax credit can be in the thousands. If you qualify for eitc, you must file a federal income tax return and claim the credit to get it, even if you owe no tax or aren’t required to file a return.

Source: uksssc.in

Source: uksssc.in

EITC Refund 7430 Amount 2024 Eligibility & Payment Date & More, The irs also reminds taxpayers that the quickest way to get a tax refund is by filing an accurate. Before you begin, make sure.

Source: www.youtube.com

Source: www.youtube.com

2024 IRS TAX REFUND UPDATE New Refunds Released, Path Act Holds, EITC, Claiming the credit can reduce the tax you owe. The irs also reminds taxpayers that the quickest way to get a tax refund is by filing an accurate.

Source: hustlehub.ca

Source: hustlehub.ca

How to Get Your EITC Refund Faster in 2024 HustleHub, [updated with 2024 refund release dates] early tax filers who claim the earned income tax credit (eitc) or additional child tax credit (actc) may experience a payment. Did you know that even after successfully filing your itr and being eligible for a tax refund, you might not receive it in certain situations?

Source: eduexamhub.com

Source: eduexamhub.com

EITC Refunds 2024 Eligibility, How To Claim EITC Refunds?, Expecting refund on excess taxes paid after filing tax returns? To claim the earned income tax credit (eitc), you must qualify and file a federal tax return.

Source: careersnexus.com

Source: careersnexus.com

600 to 7430 EITC Payment Dates 2024 Know Eligibility Criteria, The eitc is a refundable tax credit, meaning it can reduce your tax bill and possibly generate a refund—even if you don’t owe any taxes. You can use this eic calculator to calculate your earned income credit based on the number of.

The Eic Reduces The Amount Of Taxes Owed And May Also Give A Refund.

Before you begin, make sure.

If You Qualify, You Can Use The Credit To Reduce The.

If you claim the eitc, your refund may be delayed.

Category: 2024